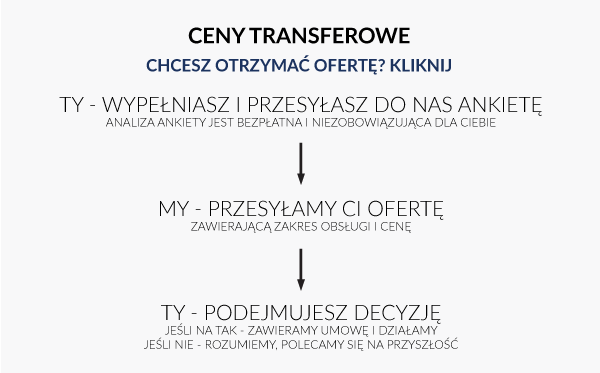

Transfer Pricing A free preliminary analysis of your situation

Contact us and fill in a short, free, and non-binding questionnaire which we will send you. On its basis, our Tax Advisors, specialising in transfer pricing, will inform you on whether the obligation to prepare transfer pricing documentation applies to you. And if so, which of your transactions are subject to documentation and which are not, and for what period of time. We will also present you with the possibilities and suggestions for further actions, together with their valuation. We ensure the complete confidentiality of all data and information you provide us. Contact with us, filling in and sending the questionnaire, and the preliminary analysis, are completely free of charge and non-binding. You will pay for our services after the conclusion of a contract with us.

TAX DOCUMENTATION of transfer pricing between related parties

My Company (or the Company for which I work) is personally- or equity-related with another company (e.g. a parent company abroad) and conducts transactions with it. Does my Company have an obligation to prepare transfer pricing tax documentation between related parties?

I have several companies in Poland, of which I am a co-owner, between which transactions are conducted (e.g. the sale of goods and services, loans, etc.). Is this also subject to the obligation to prepare transfer pricing documentation?

Important! Don’t dismiss this issue – sanctions by fiscal-control authorities in the case of the lack of transfer pricing documentation can be very severe for your Company/Companies, and even (if you are a board member, CFO or accountant) for you personally! The current regulations are becoming more and more restrictive, and the tax authorities can demand documentation from you even for a full 6 years back from today. The lack of documentation can entail the imposition of very severe financial sanctions, amounting even to millions of zloty.

This is one of our fields of expertise. Start by contacting us and filling in and sending us a short questionnaire for a free and non-binding analysis. On this basis, we will inform you on whether the obligation to maintain the documentation applies to you and your Company, to what extent, and for what period of time. Sending a completed questionnaire does not oblige you to enter into any contract with us, nor does it involve any costs, and it will allow you to find out whether the matter really relates to your Company.

You can also make an appointment with us for a free and non-binding meeting to find out what transfer pricing tax documentation is, whether your Company (or the Company in which you are a board member, CFO or Chief Accountant) is subject to this obligation, and to what extent. We will tell you what to do next, and if you decide to use our services having this knowledge, we will jointly choose the best solution for your Company. If it turns out that the documentation is necessary for you, you will be able to commission us to prepare it in the scope you have chosen so that you can sleep peacefully!